28 Jan Beyond HPAS & DHOAS: The Strategic Advantage of HPSEA in Your Property Journey

Many Defence members are familiar with HPAS and DHOAS, but HPSEA is often misunderstood as just a simple rebate. In reality, it’s a reimbursement for certain costs that arise when a posting forces the sale of a home and, in limited and approved sell-then-buy circumstances, certain purchase-related expenses. This misunderstanding can lead to rushed decisions and unnecessary stress during relocations.

When used wisely, HPSEA can ease the financial pressure of moving by helping recover costs that typically arise during a posting-related sale. Knowing how it applies within the broader set of housing benefits allows decisions to be made with intention rather than urgency.

What Is HPSEA and Why It Still Matters in 2026

HPSEA stands for Home Purchase or Sale Expenses Allowance, a type of housing support available to Defence members. It helps reimburse some of the costs that arise when a posting requires the sale of a home or the purchase of a subsequent residence as part of a relocation. This support exists because frequent moves can create unavoidable costs that wouldn’t arise for most civilians.

Unlike a purchase subsidy, this allowance focuses on the expenses around selling and, in limited and specific sell-then-buy circumstances where conditions are met, certain purchase-related costs connected to a service-directed relocation. It can help with fees such as agent commission and conveyancing costs, which eases financial pressure when selling a home as a Defence member under posting timelines.

HPSEA is still an important part of housing planning in 2026 because postings continue to drive relocations and property turnover. Knowing how and when to claim makes it possible to plan with intent rather than react under pressure, especially in the context of ongoing moves and broader housing goals.

As with all Defence housing assistance, eligibility and reimbursable costs are subject to Defence policy and individual assessment.

Who Is Eligible for HPSEA

Eligibility for HPSEA is based on specific service and posting conditions set by Defence, not simply on owning a property. The allowance is designed to assist when a home is sold because an official posting requires relocation.

To qualify for HPSEA in 2026 when selling a home, several conditions generally need to be met:

- Posting requirement – You must receive official written notice of a posting to a new location, and the sale must relate directly to that move.

- Occupancy requirement – The property must generally be your principal place of residence at the time the posting order is issued.

- Timing requirement – The contract to sell must generally be signed within an approved timeframe following receipt of posting orders, often up to two years, subject to Defence assessment and circumstances.

- Cycle continuity – Where an approved sell-then-buy sequence occurs as part of the same posting relocation, HPSEA may apply across both stages, subject to strict eligibility and continuity requirements.

A common misconception is that HPSEA Defence support is automatic any time you sell a home; it only applies when selling a home as a Defence member due to posting requirements and meeting the relevant criteria. Clear awareness of these eligibility rules ensures Defence members claim the right assistance and avoid unexpected rejection of their application.

What HPSEA Covers (and What It Does Not)

HPSEA can reimburse certain costs incurred when selling a home due to a posting, and, in limited cases, approved purchase costs when a sell-then-buy sequence applies, but it is not a lump-sum benefit that covers every possible expense. It is a reimbursement for actual expenses, meaning you must generally pay the costs first and then claim them back under the HPSEA entitlement. This is how the ADF’s reimbursement framework is structured to reduce financial pressure during Defence relocation property assistance.

Typical costs that may be reimbursed include:

- Real estate agent commission and auctioneer fees

- Solicitor or conveyancer fees charged for selling or buying

- Certain government fees are directly related to conveyancing or registration, where approved, but not stamp duty or transfer duty

These are the core costs recognised under official guidance as reasonable expenses connected to a posting-related property sale or purchase.

Costs not usually covered by HPSEA:

- Renovations, staging, gardening or pre-sale inspections

- General maintenance, cleaning or cosmetic upgrades

- Ongoing property ownership costs such as rates, utilities, loan interest or insurance

Expectations that HPSEA 2026 will cover every cost tied to moving or improving a home often lead to disappointment because the allowance is strictly linked to expenses the Department defines as reasonable and directly connected to the sale/buy cycle due to postings.

Reality check: HPSEA does not remove all costs associated with relocation; it helps you recover certain professional and government costs directly tied to the sale or purchase of a home triggered by your posting. This reimbursement model is a core part of how HPSEA Defence support operates within the broader set of ADF housing entitlements.

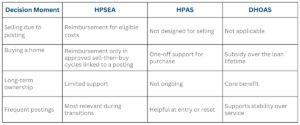

HPSEA vs HPAS vs DHOAS: The Differences That Actually Matter

These three housing supports sit under ADF housing entitlements, yet each exists for a different part of a Defence property journey. Understanding how they interact helps when making decisions about selling, buying, or settling during postings. They work together across different phases of relocation, not as interchangeable benefits.

HPSEA is focused on reimbursing certain costs that arise when you sell or buy a home because of a posting move, helping manage the real expenses of relocating.

HPAS brings a one-off payment to assist with upfront purchase costs when you enter or reset a home ownership position, giving a boost toward your next property.

DHOAS supports long-term ownership by providing a home loan interest subsidy once a suitable home is established.

Real decision scenarios, like coordinating a sell-then-buy cycle, highlight how these schemes differ and why each matters at the right time. Recognising these differences helps Defence members plan property steps in ways that align with service life rather than assume one benefit does everything.

How HPSEA Fits Into Real Defence Property Decisions

HPSEA matters most when applied to real decisions Defence members face during postings, not when treated as an afterthought. Selling a home under service direction often comes with tight timelines, limited flexibility, and unavoidable costs. This is where Defence home sale assistance can meaningfully reduce pressure during a transition.

Common decision scenarios where HPSEA plays a role include:

- Selling due to posting – A forced move may require selling earlier than planned, with HPSEA helping offset approved selling costs

- Selling to reset strategy – Where a posting necessitates the sale, some members sell to simplify debt or reposition before the next posting, using HPSEA to manage the financial impact.

- Selling while renting elsewhere – Renting between postings can provide flexibility, while HPSEA supports the cost of exiting ownership where the sale is required due to a posting.

- Selling before or after a posting change – Selling before posting orders are issued can jeopardise eligibility, while selling too long after may also risk rejection.

These scenarios show why HPSEA is less about rules and more about sequencing decisions correctly. Thoughtful planning around when and why to sell helps Defence members avoid reactive choices during relocations and maintain control over their broader property strategy.

Common HPSEA Mistakes Defence Members Make

Assumed Eligibility Without Confirmation

Many members assume they automatically qualify for HPSEA when posting orders arrive. In reality, eligibility requires meeting specific criteria tied to sale timing and posting, and confirmation should be sought before committing to contracts. Misunderstanding this can lead to costs that won’t be reimbursed later, affecting cash flow.

Selling Too Early or Too Late

Selling a home before posting orders are finalised or after key time limits can jeopardise an HPSEA claim. The allowance is linked to a narrow window around the official posting, and missing it can mean losing access to valid reimbursement for costs associated with the transaction. This timing issue is one reason planning early matters.

Not Aligning With Financial or Tax Outcomes

Some Defence members focus narrowly on the property sale without considering broader implications like loan structure or tax timing. Decisions made in isolation can reduce net returns or disrupt larger plans like settling or investing in another property. Thinking holistically and seeking advice from specialists helps prevent unintended consequences.

Treating HPSEA as a Standalone Choice

Viewing HPSEA as a quick fix rather than part of a broader property strategy often leads to sub-optimal results. It works most effectively when aligned with other decisions, such as when to sell, buy, or refinance in relation to posting cycles. Connecting sales timing with overall planning is key to making the most of the support available.

Why HPSEA Should Never Be Considered in Isolation

Selling a property during service impacts more than just the transaction itself. Timing, loan structure, and next steps can shape borrowing capacity, cash flow, and future flexibility long after a posting. This is why Defence home sale assistance often has consequences that extend well beyond settlement day.

Without a joined-up view, it is easy to focus on one decision and miss the knock-on effects elsewhere. Selling under HPSEA Defence support can influence options for the next purchase, the ability to stay mobile, and how other ADF housing entitlements apply later. Fragmented advice increases the risk of solving one problem while quietly creating another.

How Spectrum Helps Defence Members Navigate HPSEA Strategically

We work exclusively with Defence members, so HPSEA decisions are always considered in the context of service life and postings. Our role is to help confirm eligibility, clarify timing, and assess implications before commitments are made. This reduces uncertainty at moments when decisions often feel rushed.

We guide members through property, lending, and tax considerations as part of one coordinated plan. Selling decisions linked to HPSEA are assessed alongside borrowing capacity, future housing choices, and posting flexibility. The result is clearer decision-making and confidence through transitions, whether the next step is buying, renting, or staying mobile.

Turning HPSEA From a Rulebook Into a Strategy

HPSEA is most effective when it is understood in context rather than treated as a last-minute checklist item during a posting. The biggest risk is not the allowance itself, but misunderstanding it or leaving it unused when decisions matter most. Clear planning consistently produces better outcomes than guesswork, especially under time pressure.

Taking a considered approach to selling helps property decisions feel deliberate rather than reactive. When housing support is viewed as part of a broader plan, flexibility across postings and future goals becomes easier to maintain.

If you want clarity on how HPSEA applies to your situation, book your free consultation today and make confident, well-timed decisions around your Defence housing benefits.